What makes up a credit score? Your credit score is an excellent indicator of your financial well-being. It is your track record of paying your payments on time. If you utilize credit responsibly, you will have a good credit score; if you do not, you will have a poor credit score.

Credit scores are used by businesses to determine whether to lend you a mortgage, credit card, vehicle loan, and other credit products, as well as for screening potential tenants and insurance. They are also used to calculate your interest rate and credit limit.

Several factors influence your credit ratings, including whether you pay your payments on time and how long you’ve used credit. Understanding what variables affect credit scores allows you to design the most efficient method to enhance or protect your credit.

What is a credit score?

One of the most crucial indicators of your creditworthiness is your credit score. It’s a number with three digits spanning from 300 and 900. The greater your score, the better your credit. The more probable it is that prospective lenders will perceive you as an accountable borrower who pays your financial obligations on time.

Credit score ranges

As previously stated, Canadian credit ratings range from 300 to 900. Although every prospective lender will have their standards for what credit scores are acceptable, the Equifax range is a reasonable guideline. A credit score of 300 to 559 is considered poor, while a score of 560 to 659 is considered fair. A decent credit score ranges from 660 to 724. If your credit score falls between 725 and 759, it’s deemed excellent. A credit score of 760 or more is generally considered to be outstanding. The higher your credit score, the more probable you will be approved for loans and credit. You’ll also have a better chance of getting the best interest rates.

What makes up your credit score?

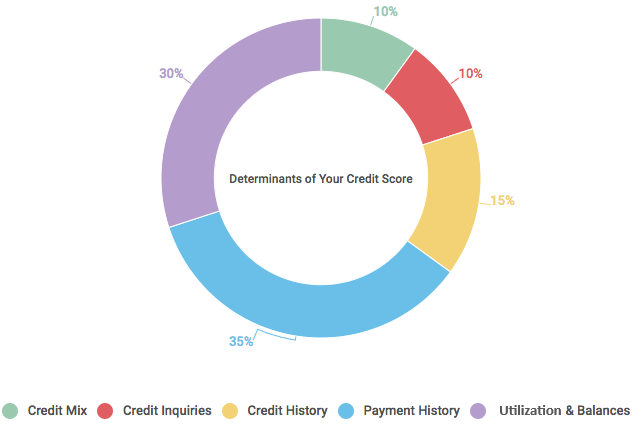

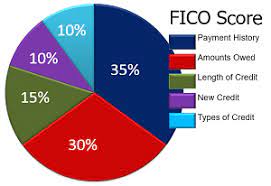

Equifax and Transunion are Canada’s two significant credit bureaus. They are in charge of calculating people’s credit ratings. Even though we don’t know the specific algorithm used by each of Canada’s two credit bureaus to determine your credit ratings. Most credit rating algorithms use the same five elements.

- Payment History. 35% of your overall score is influenced by payment history. This indicates whether you make payments on time and how frequently you miss payments. And how many days beyond the scheduled date you pay your expenses, and how recently payments have been skipped. Payments made more than 30 days late are usually reported by your lender and reduce your credit scores. Variables include the amount you owe on a bill, the total number of accounts with outstanding payments, and if you’ve got the account up to date. The more timely payments you make, the greater your credit rating. Every missing payment decreases your credit score.

- Utilization & Balances. Credit usage, which accounts for 30% of your credit score, evaluates what percentage of your overall available credit you’re utilizing at any given time. Therefore, if your total borrowing capacity on all your credit cards and lines of credit is $50,000, and you have $25,000 in remaining balances on that available credit, your credit usage ratio is 50%. Experts urge that you keep your credit usage ratio around 35%.

- Credit History. The duration of your credit history contributes about 15% of your score. The longer you’ve had your accounts open, the better it may be for your credit. It’s advantageous because it provides additional details about your purchasing patterns.

- Credit Mix and or Public Records. This factor contributes 10% to your overall score. Equifax seems to put greater weight on information obtained from public sources, such as whether you have a history of bankruptcy or late bills forwarded to collection agencies. On the other hand, TransUnion seems to give more thought to the various forms of credit you utilize. Look for a good balance of revolving credit accounts like credit cards and lines of credit and installment accounts like student loans, vehicle loans, or mortgages.

- Credit Inquiries. This factor accounts for the remaining 10%. The number of credit checks or queries you’ve had recently impacts your new credit. Only hard inquiries (when a lender reviews your record to make a lending decision) are counted; soft pulls are not. If you’re checking your credit score or validating your identity with a provider, it does not count. Each credit inquiry remains on your credit record for two years. More inquiries may indicate possible financial difficulties, which may reduce your score.

Depending on your circumstances, the weight allocated to each category may differ. If you’re just getting started with credit, the elements utilized to construct your score may vary from those used for someone with a lengthier history of credit.

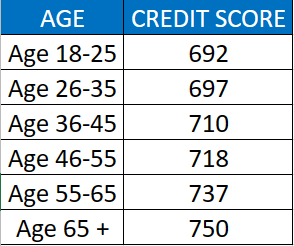

Average credit score by age group

As stated by Equifax Canada, a significant credit bureau in Canada. The average credit score for Canadians under the youngest age group is 692, whereas those 65 and above have an average credit rating of over 740. According to historical data, the average credit score rises with age. The average credit score in Canada varies by age group. See below.

Credit scores are simply numbers lenders and other companies utilize to assess an individual’s creditworthiness. They are not a precise science, and other aspects of your finances influence your capacity to reach your financial goals. However, having a good credit score might help you enhance your financial assurance and security. To receive the most favorable offers, keep your credit in good standing. You can change your credit score since it is yours.

On the other hand, if you need a car loan, we can help. We offer a variety of car loans to clients with all types of credit at Edmonton Auto Loans. Get pre-approved right now! If you’d like immediate assistance, contact us at 1-855-227-1669.